What is inflation? It’s a depreciation of money. Economic theory tells us that there are two main types of inflation – demand inflation and cost inflation. In the first case, too much money is running after too few goods.

In the second case, an overheated economy generates a huge demand for resources, the prices of which start to rise rapidly. In the end, it leads to higher costs and provokes higher prices.

As a result of a multi-year policy of multiple quantitative easing, we can see the emergence of a new type of inflation – asset inflation. It has not yet been studied in macroeconomics and financial science. At the same time, we can see that negative returns on money have become the norm. Money no longer brings income and possession of money has begun to bring losses. We are dealing with zero or even negative rates on deposits. But this does not agree with the classical definition of money in economic theory. It follows that the modern financial system has destroyed money in their classical sense.

Of course, inflation is the main factor determining this trend. The situation in Russia is more or less clear. For several decades, we have been experiencing inflation in demand in its most extreme form – in the form of a total deficit. With America, it is much more difficult. The economy is at its cyclical peak, and unemployment is at its historical minimum. Yet Americans feel depressed: the cost of rent, health insurance, schooling, and other basic living expenses are rising much faster than their wages. This creates real problems for ordinary people. More and more Europeans and Americans are turning to irresponsible populist politicians. They promise a sour shores: a minimum wage of $15 or the universal basic income already proposed in the Swiss referendum. I personally take my hat off to the Swiss, who refused to receive CHF 2000 for free, just because it would kill motivation. And how would the poor Russians vote in this referendum? It’s a rhetorical question.

The vanishing middle class…

Let’s go back to the United States. Since the early 1970s, due to wage stagnation and rising costs, the situation in the American middle class has been disappointing. The class is just starting to disappear, and there is even a known exact date when it began – August 15, 1971.

This is the day President Nixon killed the last remnants of the gold standard. Since then, the dollar has been pure paper currency. This allows the Fed to print as many dollars as the soul wants. Without the discipline imposed by some form of gold standard. Since 1971, the US money supply has exploded by 2.106%.

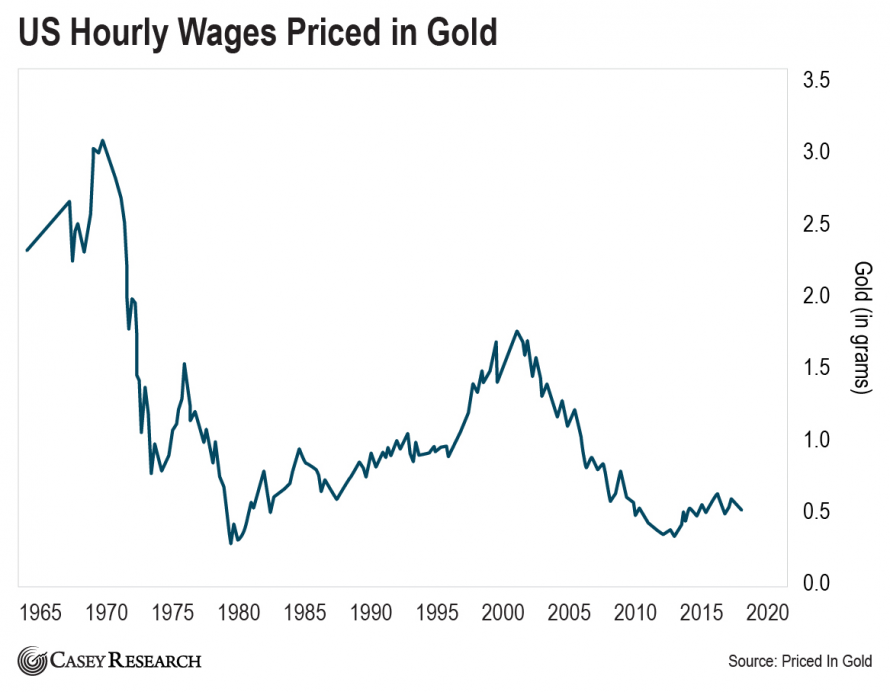

The following graph illustrates this trend. It measures the U.S. hourly wage according to the graph in gold grams (the number of gold grams received by the hourly income of an average person).

Salaries in the USA have fallen by more than 84% since 1971. That’s a lot!

By the way, the minimum wage in 1968 was $1.60, and today it is $7.25. It’s 353% higher in dollar terms. But the fact that 7.25 dollars buys 87% less than 1.60 dollars in 1968 is a great mystery!

The vicious circle

As a result, the policies demanded by people who suffer from inflation create more inflation. The more it affects living standards, the more people vote for programs that make the situation even more difficult. This includes such things as universal basic income and high minimum wage, which creates the inflation cycle. As a result, prices are rising faster than wages are rising. The average person feels bad, but does not understand what is happening. More people support politicians who promise them wealth without concern. The government prints more money to pay for the “wealth effect”, namely the prohibitive level of stock indices and other assets. This creates more inflation and the cycle repeats itself.